One area that every business should constantly evaluate is whether it is not only complying with the law, but also whether it is using the law to its maximum advantage. The following are five, non-exclusive, areas that every business should review with its attorney, at least on an annual basis.

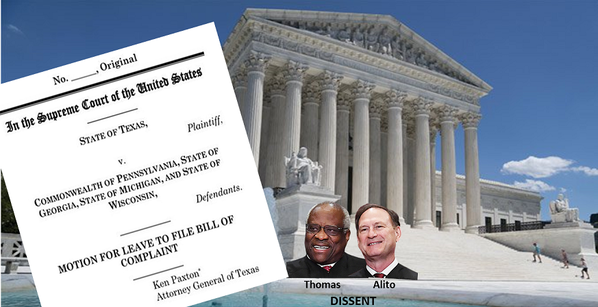

1. Compliance with New Laws and Court Decisions

The federal government and state legislatures are constantly passing new laws that affect businesses. Additionally, federal and state courts are constantly interpreting laws, as they apply to specific businesses and circumstances. Business lawyers work hard to keep abreast of these changes so that their business clients can focus on their businesses, and not on the law.

2. Changes in the Structure of Your Business

Businesses sometimes start out as sole proprietorships or partnerships. Often, however, once a business grows, it is best to transition to a business entity. There are a number of entity options from which a business client can choose. A business attorney can assist not only by helping a business client select an appropriate entity type, but also by drafting the legal documents needed to take maximum advantage of the benefits that are available with a particular type of business entity.

The avoidance of legal disputes and limiting legal liability are the primary considerations in business entity formation. Tax planning is important; however, business entity selection and formation should not be based solely on tax considerations.

A word of caution: Certified Public Accountants (CPAs), because they assist businesses with tax issues, are authorized by law to form business entities for their clients. Most CPAs, however, are not attorneys and, thus most CPAs may not lawfully give legal advice.

A business attorney, unlike a CPA, is able to provide business clients with Attorney-Client Privileged legal advice on all aspects of business entity formation and operation, including tax planning.

3. Legal Liability/Risk Management

There are certain legal risks that are inherent in every type of business. For example, grocery stores historically have experienced greater legal risk from “slip-and-fall” lawsuits than most other businesses. Likewise, delivery and courier services usually experience greater legal risk from motor vehicle accidents than most other businesses.

Regardless of the nature of your business, there likely is one or more areas of your business operations that expose your business to heightened levels of legal risk. Regular, at least annual, review of these areas of your business operations is crucial to effective legal risk management.

4. Business Contracts

Many businesses find, as they grow and gain more experience, that the contracts they use with their customers either don’t adequately address certain situations, or perhaps don’t address those situations at all. A business attorney can draft or revise a business entity’s contracts so that those contracts provide the business client with legal protection that are designed to maximize the business client’s revenues and minimize its legal troubles.

5. Employee/Independent Contractor Issues

Every business needs personnel in order to serve its customers. Employee and independent contractor issues, in turn, can be as varied as workers themselves. It follows, then, that every business should constantly be aware of employment law issues that may affect its continued and future operations. Although more frequent attention to personnel issues is often required, an annual legal review of these issues, including personnel status, employee handbooks, and personnel policies, should be considered the absolute minimum.

Contact us today by calling (877) 570-2200, or CLICK HERE to send us an email

|

For more information on the Business Law services that are available through Lapin Law Group, watch our popular video below.

|

Learn how you can have a Lawyer Available Whenever to review your legal documents and answer your legal questions. Watch our popular video below.

|

GET A FREE e-BOOK

Lapin Law Group, with its principal office in the Dallas-Fort Worth Metroplex, serves all 254 Texas counties.